child tax credit 2021 dates irs

13 opt out by Aug. The tax credit is aimed at helping parents.

Irs Announced Monthly Child Tax Credit Payments To Start July 15 Forbes Advisor

The American Rescue Plan Act of 2021 increased the amount of the CTC for the 2021 tax year only for most taxpayers.

. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. 2 days agoNovember deadlines loom to claim credits. The credit amounts will increase for many.

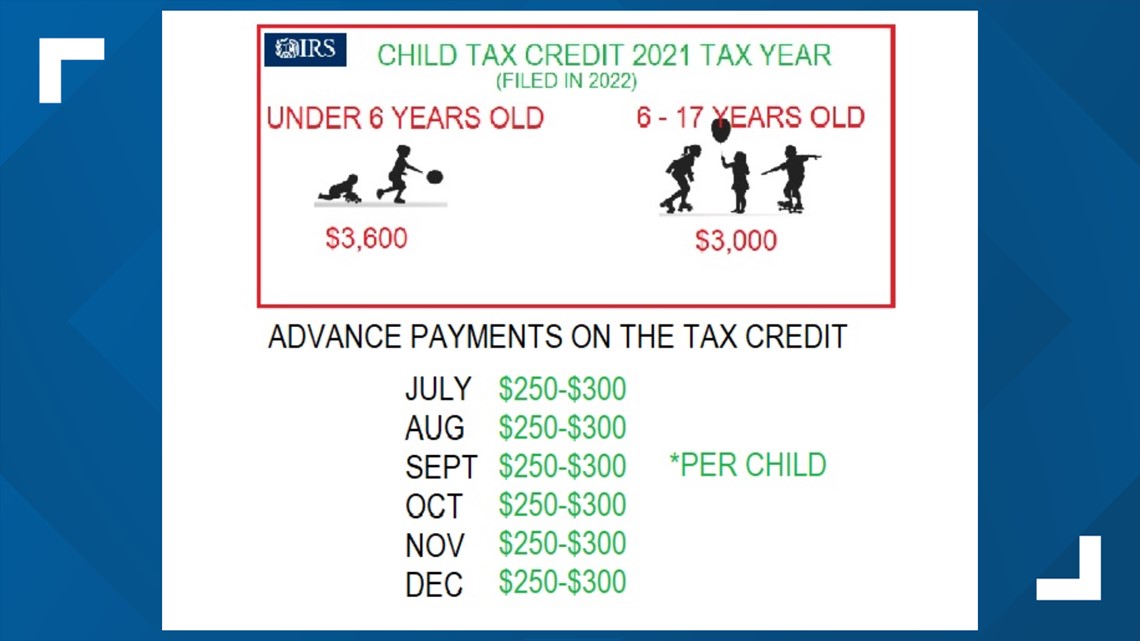

The enhanced Child Tax Credit increased this benefit as high as 3600 a child in 2021 up from its normal amount of 2000 per child. A childs age determines the amount. Enhanced child tax credit.

The IRS said it will update its Child Tax Credit Update Portal later this year to allow parents to register children born or adopted in 2021. 1200 sent in April 2020. Tax Year 2021 Form 990-N e-Postcard Tax Period.

Child Tax Credit. Tax Year 2021 Form 990EZ. For 2021 the credit amount is.

15 opt out by Aug. Information on how to claim the 2021 Child and Dependent Care Credit can be found on page 41 of the NJ-1040 Instructions. The American Rescue Plan Act ARPA of 2021 made important changes to the Child Tax Credit CTC for tax year 2021 only.

If parents dont do this they will be able to. The IRS Free File tool is scheduled to stay open until Nov. A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive.

Have been a US. Enhanced child tax credit. How much money you could be getting from child tax credit and stimulus payments.

On March 11 2021 President Biden signed into law the American Rescue Plan Act expanding the Child Tax Credit and providing historic tax relief to the vast majority of families. 17 for people who still need to file 2021 tax returns. Here are the official dates.

You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors. The credit will reduce the amount of New Jersey. Credit per dependent child under 6.

For 2021 eligible parents or guardians. The deadline to file 2022 taxes will be Tuesday. Visit the Internal Revenue Service.

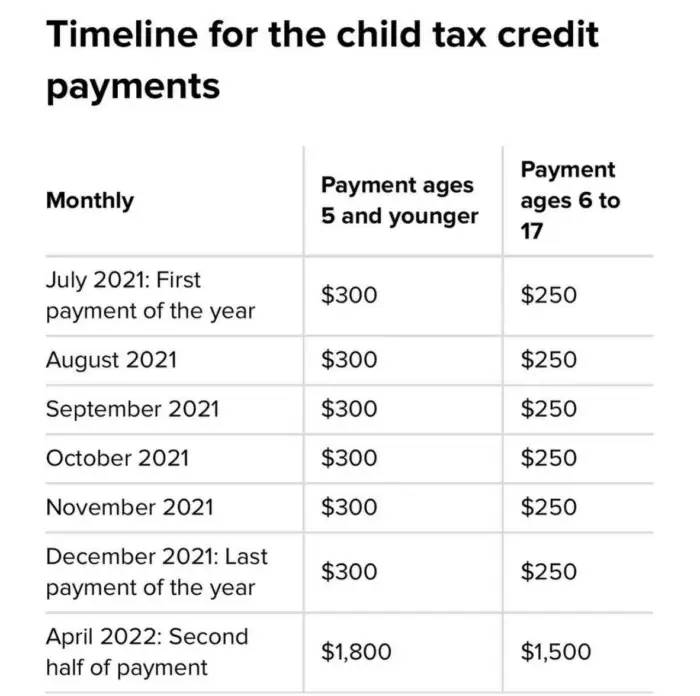

To get money to families sooner the IRS is sending families half of their 2021 Child Tax Credit as monthly payments of 300 per child under age 6 and 250 per child between the ages of 6 and. Up to 3600 per child or up to 1800 per child if you received monthly payments in 2021. But this year parents can receive 3600 for children under 6 years old and 3000 for kids between.

10 hours agoThe child tax credit payments of 250 or 300 went out to eligible families monthly from July to December 2021. Up to 3600 per child or up to 1800 per child if you received. For purposes of the Child Tax Credit and advance Child Tax Credit payments your modified AGI is your adjusted gross income from the 2020 IRS Form 1040 line 11 or if you havent filed a.

If they opt-in for the. Up to 3600. Images of Forms 990 990-EZ 990-PF or 990-T returns filed with the IRS by charities and non-profits.

Depending on the age of the children some families. The payments will be made either by direct deposit or by paper check depending on what. NOVEMBERs child tax credit cash will be sent out to parents in need across the country next weekThe stimulus check part of President Joe Bidens.

2021 rules going away. How parents can claim their Child Tax Credit for babies born in 2021.

News On 2021 Child Tax Credit Refunds Irs Hiring Plans Canon Capital Management Group Llc

Taxpayers Now Can Go Online To Opt Out Of Advance Child Tax Credit Payments Verify Eligibility Don T Mess With Taxes

Last Day To Unenroll In July Advanced Child Tax Credit Payment

Child Tax Credit Update Next Payment Coming On November 15 Marca

Irs On 2021 Tax Information For Stimulus Checks Child Tax Credits

Irs Makes First Payments Of Advanced Child Tax Credit On July 15 Wfmynews2 Com

2022 Irs Tax Refund Schedule Direct Deposit Dates 2021 Tax Year

Publication 972 2020 Child Tax Credit And Credit For Other Dependents Internal Revenue Service

How To Opt Out Of Advanced Child Tax Credit Payments And Why Some Accountants Advise It Wbma

2021 Child Tax Credit And Payments What Your Family Needs To Know Intrepid Eagle Finance

Irs Warns Parents Not To Toss Important Tax Document

/cloudfront-us-east-1.images.arcpublishing.com/gray/52G57ZTTS5BLZL73DTPNV77Q7Y.PNG)

Irs Warns Parents Not To Toss Important Tax Document

Irs Sends Millions Letters About The Monthly Child Tax Credit Payments Forbes Advisor

Parents Are Getting Another Monthly Child Tax Credit Payment This Month Here S What To Know

Information From The Internal Revenue Service Heads Up About Advance Child Tax Credit Payments Hartford Public Schools

Child Tax Credit Monday Is The Deadline To Pick One Big Payment Over A Monthly Check Wgn Tv

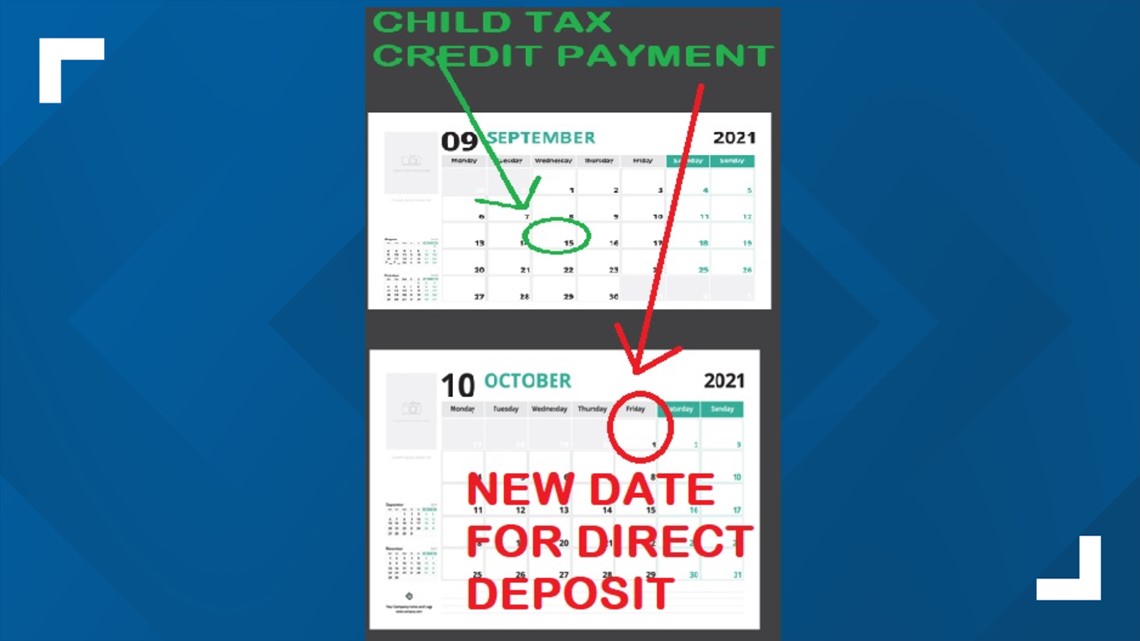

Irs Delays Some September Child Tax Credit Payments Until Oct Wfmynews2 Com

Child Tax Credit Eligibility Who Gets Irs Payments This Week Wwmt